r&d tax credit calculation software

How to Use the Strike RD Tax Credit Calculator. We also offer subscription based calculators including residential cost segregation software for rental properties partial disposition and 481a calculations.

Before you can calculate the amount you receive in RD tax credit carryforward youll need to ensure that your business is located in the US and pays tax.

. What expenses qualify for the research and development tax credit. Check out our RD Tax Credit Calculator to see how much you can save. For startups applying the credit against payroll taxes is a valuable non-dilutive funding opportunity.

The RD Tax Credit was originally introduced in the Economic Recovery Tax Act of 1981 sponsored by US. The RD tax credit is available for companies that design develop or improve products processes techniques formulas or software. Calculating RD Tax Credits.

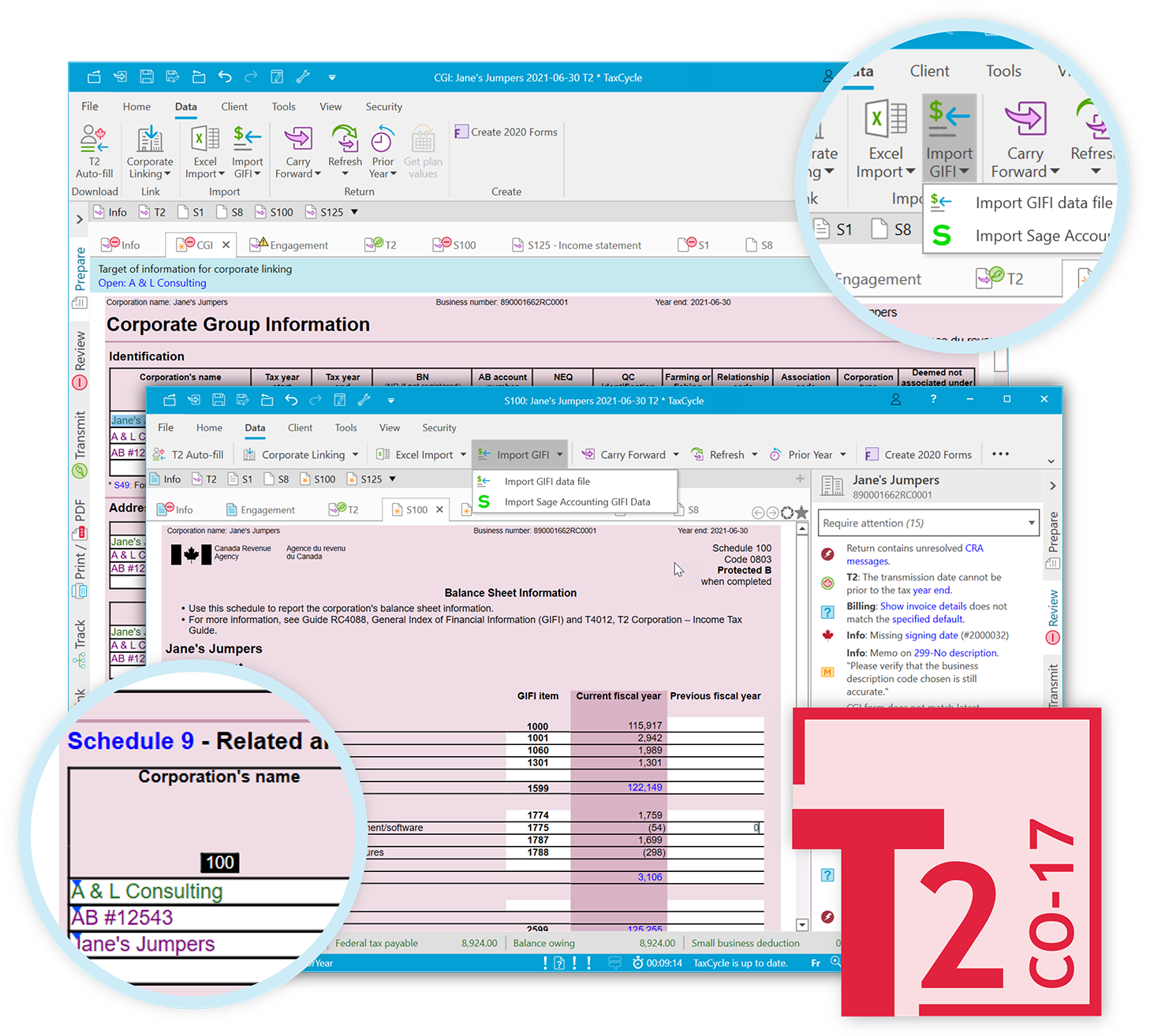

Total number of employees in your business. Our software streamlines the way to capturing the RD credit in the most accurate and IRS defensible way. Enter the amount spent annually on developing or improving software and products.

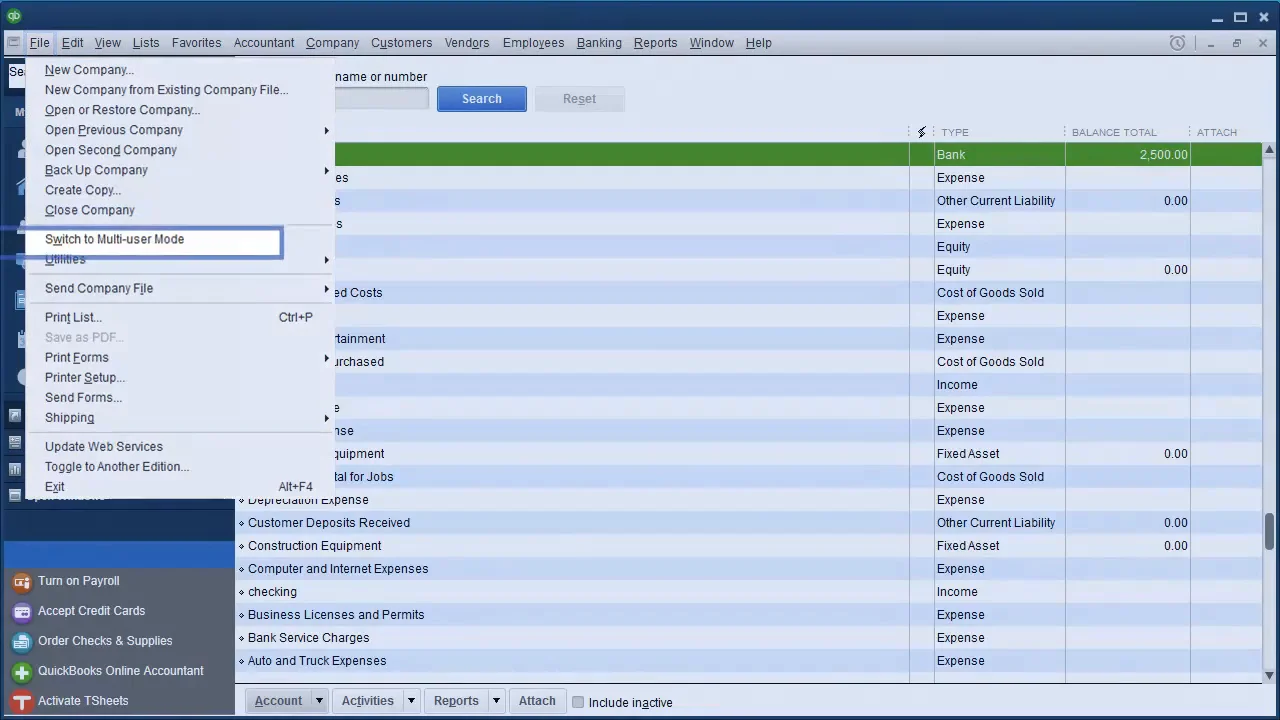

Multiply average QREs for that three year period by 50. With the help of RD tax credit software you can determine which company costs qualify for the tax benefit. The alternative simplified credit method involves a four-step process.

Looking to capture the credit for past years missed. Our Look-Back study can help reclaim credits cash refunds for overpayment of your taxes. Identify and calculate the companys average qualified research expenses QREs for the prior three years.

The Credit For Increasing Research Activities RD Tax Credit is a general business tax credit under Internal Revenue Code Section 41 for companies that incur research and development RD costs in the United States. Guidance on this can be found on our Which RD scheme is right for my company page. Driven by IRS audit guidelines our software calculates your credit in real time.

Were here to make sure every qualified company gets the most out of their RD tax credit. Then youll need to have the following figures on hand. And you can automatically generate reports you need to substantiate.

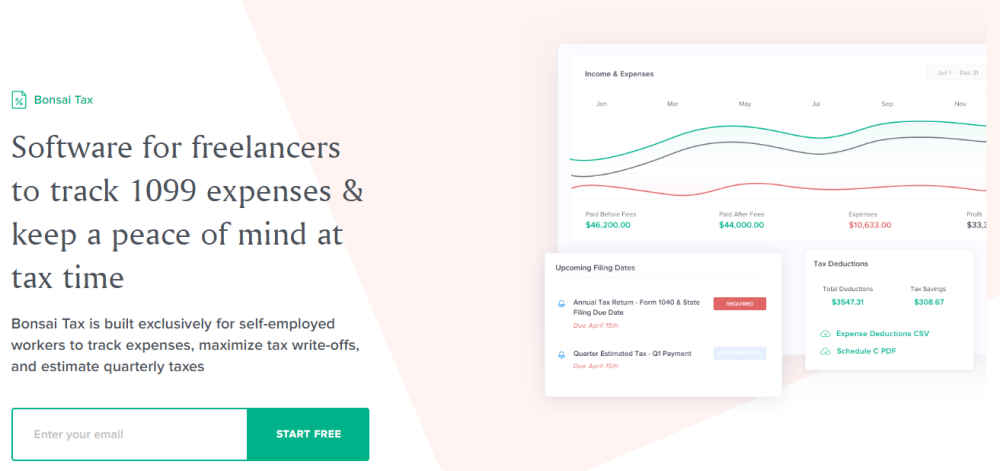

We believe the best way to do that is with a customized mix of technology and support and to walk with you every step of the way. Plus it carries forward 20 years. According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in 2020106 billion for corporations and 12 billion for individuals.

Credits for software companies can result in a credit exceeding 10 of expenditures but some potential limits exist. We provide assistance with RD tax credits cost segregation repair v capitalization review section 45L credits section 179D transfer pricing IC-DISC and California Competes tax credits. Company X made profits of 400000 for the year calculate the RD tax credit saving.

4 The RD tax credit was first established in 1981 in the Economic Recovery Tax Act ERTA. Select whether the company is profitable or loss making. Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief.

From biotech to breweries were on a mission to democratize the RD tax credit. Learn all about it here. These are categorized under Qualified Research Expenditures QRE and can be discovered more in detail here.

Maximize credit with defensible claims. Technically the credit is to help increase research activities and its calculated based on the difference between your RD expenses in the current year and the amount you spent in previous years. Youll need your average annual gross receipts the taxable year and some help from your accountant to figure out your income tax liability payroll tax liability and qualified rd expenses.

This is a dollar-for-dollar credit against taxes owed. Plus every study is reviewed by RD tax credit experts. 100000 130 130000.

Fiona performs the local RD tax credit calculation utilizing the qualification of projects and activities along with details of the associated expenses. Enter amount for annual spend on RD staff. Clarus RD for your business.

For most companies the credit is worth 7-10 of qualified research expenses. Your credit calculations can be automatically rolled over and updated each year adjusting to new forms deadlines and limitations so you stay in compliance with new. Select the states where your employees reside.

A 230 total saving. R. Enter amount for annual spend on RD subcontractors.

Microsoft was only a small company back then but Congress passed the first version of the RD tax credit promoting research activities. Enhanced RD qualifying spend or uplift. Just follow the simple steps below.

It all began in 1981 when IBM released its first computer using the software known as MS-DOS. Whats your annual spend on subcontractors working on RD. If you want to get an idea of how much you can save with this tax credit we also offer a free assessment to help you calculate the RD tax credit.

The RD tax credit calculation is a percentage of the current-year QREs over a base amount. Select either an SME or Large company. The qualifying expenditure is 100000 thats already in accounts as expenditure.

The base amount is calculated using prior-year QREsTaxpayers are required to maintain consistency in the calculation and must demonstrate consistency between QREs in the credit year and QREs in the base period years. 76000 - 51300 24700 approximately 25 2. The corporation tax saving.

Subtract half of the three-year average Step 2 from current year QREs. In general profitable SMEs can benefit from average savings of 25 so if a company were to spend 100000 on R. RD Tax Credit Calculation.

R D Tax Credit For Software Development Leyton Usa

R D Tax Credit Calculation Methods Adp

Best Financial Reporting Software Reviews Comparisons 2022 List Of Expert S Choices

What Is Sr Ed A Comprehensive Explanation What Is Sred

50 Free Easy Sop Templates Sample Sops To Record Standard Procedures Process Street Checklist Workflow And Sop Software

Download Sales Commission Calculator Excel Template Exceldatapro

10 Best Workforce Management Software Of 2022 People Managing People

The R D Tax Credit Aspects Of Saas Start Ups R D Tax Savers

Itxmouazumer I Will Do Data Entry B2b Lead Generation Admin Tasks Web Research Expert For 5 On Fiverr Com Web Research Lead Generation Data Entry

10 Efficient Tax Planning Software For Small To Medium Business Geekflare

Proseries Tools And Features For Basic And Professional

Advantages Of Using Accounting Software Zoho Books

Understanding The R D Tax Credit A Guide For Tax Practitioners Advisors Youtube

10 Best Accounting Software For Real Estate In 2022

R D Tax Credit For Software Development Leyton Usa

Accounting Cheat Sheet Pdf Debits And Credits Depreciation Accounting Process Accounting Bookkeeping And Accounting