typical closing costs for buyer in florida

On average youll pay 34 of the purchase price of your home in closing fees. A sellers net sheet is a document that lists all the typical Florida closing costs with blanks to fill in specific values.

How Much Are Closing Costs In Florida

He graduated from the University of Central Florida in 2012 with a BSBA.

. Texas Seller Closing Costs Net Proceeds Calculator. Whats included in Florida closing costs for both the buyer and the seller. Keep in mind that this is only an estimate.

In addition to the closing costs and fees which can range from 2 to 3 of your home loan you will be making more mortgage payments if you extend your loan terms. Real Estate Commission 5. The lender will list these costs in an estimate of closing costs called The Good Faith Estimate.

To calculate typical buyer closing costs start by determining your down payment and what kind of loan. Complete Consumer Guide to Closing Costs. However seller closing costs are deducted from the.

ClosingCorp averaged statewide data for 16 million single family homes in 2019. That can add up. How to Be Prepared for Closing Costs.

Closing costs dont include your down paymentWhen youre buying a home you may be able to negotiate for the seller to pay for all or part of your closing costs as well. This form lists all final. Typical Seller closing costs in Florida include the following items.

This is given to the buyer no more than three days after applying for a loan. Lets take a look at a list of Florida typical closing costs and whos usually responsible for covering them. The typical 5 to 6 commission paid by the seller is intended to be split equally between the listing agent and the buyers agent.

Enter the property sale price or list price and then enter the various closing costs. Including the seller paid closing costs and real estate commission if applicable. Easily calculate the Texas home seller closing costs and seller net proceeds with this home-sale calculator.

The following table shows average statewide closing costs with and without property taxes. Closing Costs the Seller Traditionally Covers. Great tool for the TX Realtor or the for sale by owner FSBO.

There is a limit to how much a seller can pay for though. Closing costs and additional fees In a real estate transaction many closing costs are the buyers responsibility but there are closing costs for sellers as well. If you multiply this by the typical closing cost percentage 5-10 youll find that your closing costs will range anywhere between 13750 and 27500.

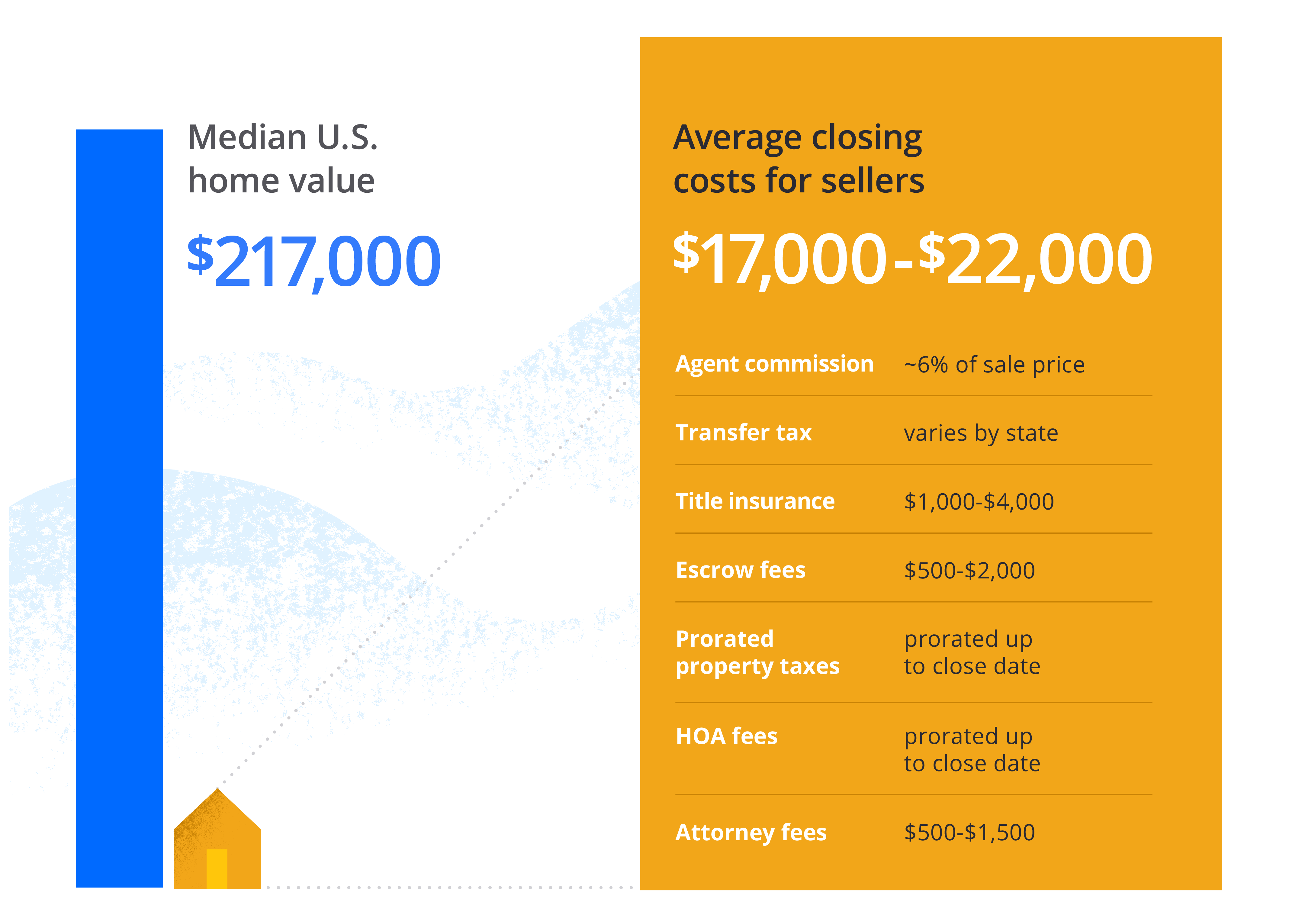

Typical closing costs for sellers. In 2019 the NAHB performed a national survey consisting of data from over 6500 home builders. Second mortgage types Lump sum.

In the United States average closing costs for homeowners are about 3700 though that depends heavily on home price and location. There is no cut-and-dried rule about whothe seller or the buyerpays the closing costs but buyers usually cover the brunt of the costs. 16 votes - 82.

What Are Average Closing Costs for a Seller in Florida. The typical rate for an ALTA survey ranges from 2000 to 3000. Fees and taxes for the seller are an additional 2 to 4 of the sale.

While closing costs are normally divided among the buyer and seller nothing is set in stone. If for example you have been. People typically get these services to qualify with a lender when they are purchasing a commercial property though those purchasing residential properties may also get this thorough option to.

Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. This sheet will usually be filled out by the listing agent and it gives the seller an up-to-date look at exactly how much they stand to clear from the home sale. One of the main reasons why commissions remain elevated in NYC is because the vast majority of buyers work with buyer agents.

6 For example if your home costs 300000 you might pay between 9000 and 12000 in closing costs. Proration of Property Taxes 3. With the median home price in the US.

This means that if you take out a mortgage worth 200000 you can expect closing costs to be about 6000 12000. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. At least three business days before closing your lender must send you a Closing Disclosure.

An escrow account is established by the lender at closing with funds from the home buyer. As we mentioned above all closing costs are. Second mortgages come in two main forms home equity loans and home equity lines of credit.

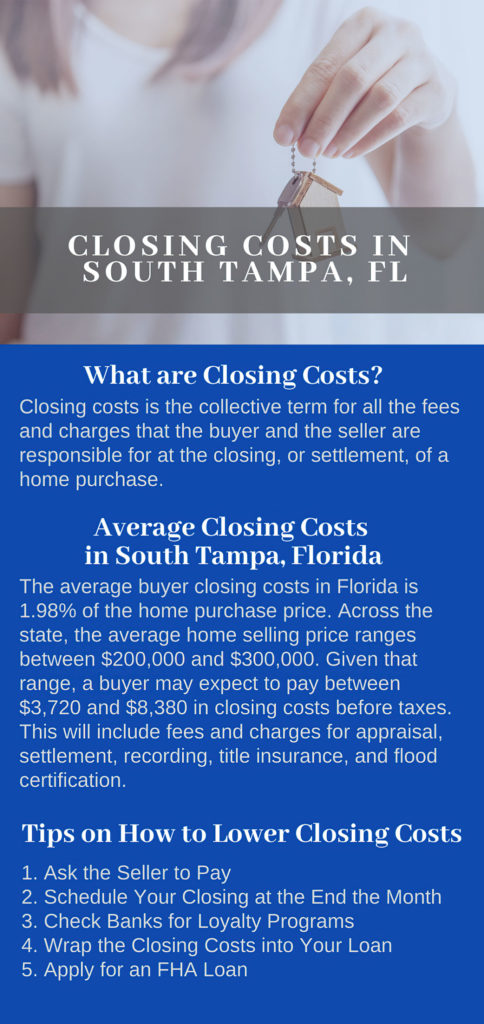

So if you are thinking about buying a home or condo in the Sunshine State you have come to the right place for a complete breakdown of the typical buyers closing costs in Florida. A sellers net sheet helps the seller keep track of where exactly all the money is going how much. For the seller this cost comes out of the profit youll make on the home on closing.

This loan often works well for first-time homebuyers because it allows individuals to finance up to 965 percent of their home loan which helps to keep down payments and closing costs at a minimum. Closing costs can make up about 3 6 of the price of the home. While closing costs will always have to be paid your real estate agent can often negotiate who pays them you or the buyer.

This article has been viewed 173345 times. The lender eventually uses the money to pay costs like property taxes homeowners insurance flood. Closing costs for sellers can reach 8 to 10 of the sale price of the home.

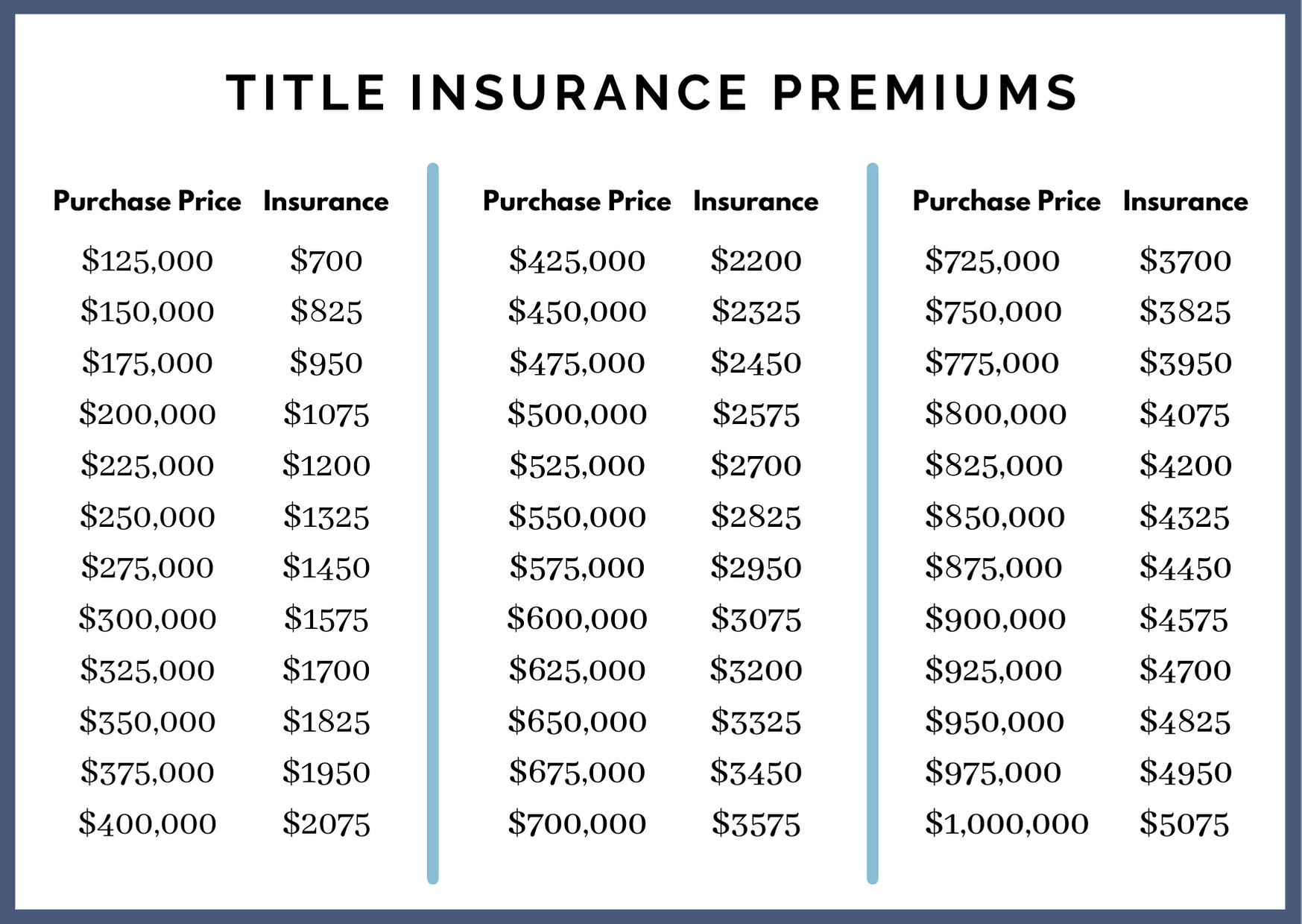

Mortgage closing costs range from 2-5 of a homes purchase price. It is an assessment according to the standards of the American Land Title Association and is one of the most extensive options. Title Search A home purchase requires a title company to establish clear ownership of the property and if there is a marketable title which is to say if the sale is legal.

But many sellers are eager to pay your closing costs in order to sell their home faster. Each loan type conventional FHA VA and USDA sets maximums on seller-paid closing costs. That data showed that the typical overhead on construction projects in 2019 was roughly 11 and the typical profit was roughly 9.

In Column A enter the property sale or list price on Line 1 and then enter the various closing costs. Keep in mind that every seller will be paying a few fees while others can be negotiated with the buyer. So for a 20000 project that costs 15000 in materials and 2500 in overhead the remaining 2500 is the profit.

Its higher than the buyers closing costs because the seller typically pays both the listing and buyers agents commission around 6 of the sale in total. Buyers closing costs on a house in Florida can vary depending on what you purchase and how you pay for it. To accomplish this the title insurance company.

When a buyer gets their loan the lender might require them to pay costs like property taxes and homeowners or rental property insurance in advance. Average closing costs for sellers range from 8 to 10 of the homes sale price including both agent commission about 6 of the sale price and seller fees about 2 to 4. Easily calculate the Florida home seller closing costs and seller net proceeds with this online worksheet.

The 203b home loan is also the only loan in which 100 percent of the closing costs can be a gift from a relative non-profit or government agency. Needless to say the. In Florida youll pay about 17 of your homes final sale price in closing costs not including realtor fees.

Sellers are averse to offering less than 25 to 3 to a buyers agent because it may have an impact on how much demand. Click on Print Column A to print a nice clean closing cost estimate for the Florida home seller.

How Much Are Closing Costs In Florida

Closing Costs Definition Types Average Amounts

Closing Costs When Paying Cash For A Property Financial Samurai

What Are Buyer S Closing Costs In Florida

How Much Does It Cost To Sell A House Zillow

Home Mortgage How Much Are Closing Costs Home Mortgage Center

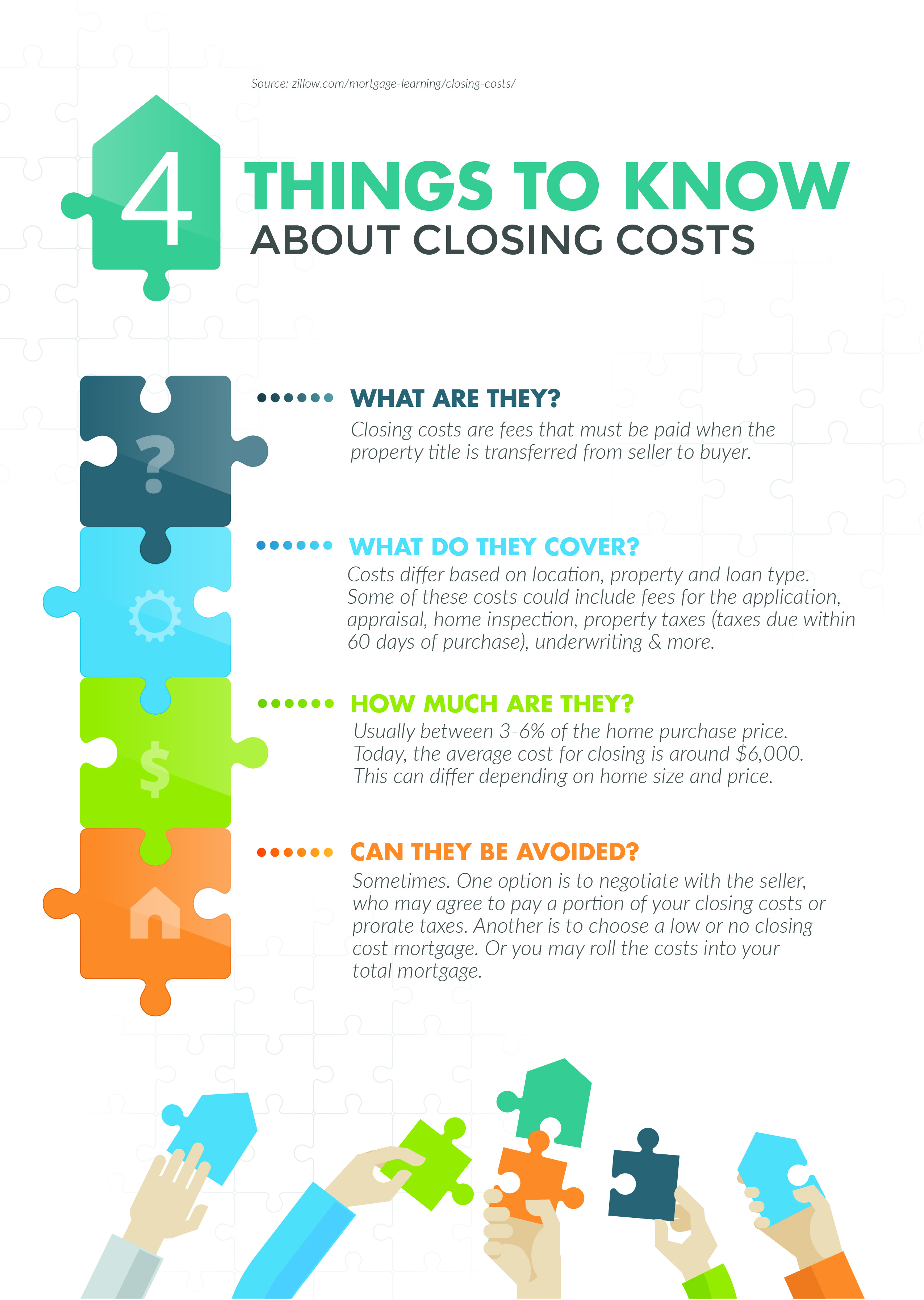

4 Things To Know About Closing Costs Compass Mortgage Llc

What Are Buyer S Closing Costs In Florida

Closing Costs In River Strand Golf Country Club Manatee County Fl

Florida Buyer Closing Costs How Much Will You Pay

What Are Buyer S Closing Costs In Florida

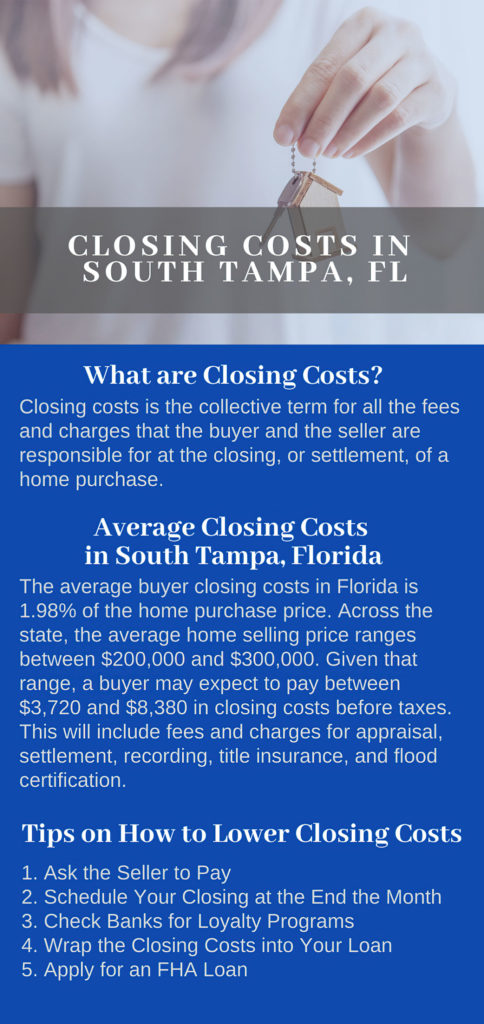

Closing Costs In South Tampa Florida Ellen Zusman Your Realtor

Florida Real Estate Buyers Guide To Closing Costs Stavros Mitchelides Miami Beach Realtor

What Are The Seller Closing Costs In Florida Houzeo Blog

Typical Closing Cost Who Pays What

4 Things To Know About Closing Costs New Dwelling Mortgage

What Are Closing Costs For A Buyer In Florida Hauseit

The Ultimate Guide To Closing Costs In Florida Streamline Mortgage Solutions